Based on what you see at the movies or on TV, you might assume you or your employees will only need legal help if you experience some dramatic and life-altering event. But the truth is most people will have a legal need at some point in their lives – usually under fairly common circumstances.

In fact, many legal needs don't involve ever setting foot inside a courtroom and revolve around tasks like document preparation or contract reviews.

10 common situations where you might need legal help:

- When purchasing or selling a house, you may need a lawyer to review the purchase agreement and contract.

- Your college-aged son or daughter has moved out of a rental property and needs legal help in getting a security deposit returned from the landlord.

- Someone in your family experiences identity theft and needs help recovering assets, or you notice a mistake on your credit report and need help getting it corrected.

- You are working on a major home remodel and need someone to review the work agreement you've established with your contractor(s).

- You're drafting or revising your will.

- You need legal advice during an IRS audit.

- A car breaks down while under warranty, and you need help getting the manufacturer or dealer to honor the warranty.

- You're adopting a child and need a lawyer to help you complete the necessary paperwork and guide you through the adoption process.

- You believe you were issued a traffic violation in error and decide you want to fight the violation.

- You're getting married and would like a pre-nuptial agreement with your future spouse. Or you're getting divorced and need an attorney's help with child custody, alimony or name change.

How ARAG legal insurance helps

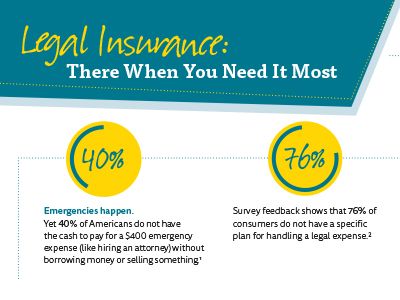

Because many routine life events require legal assistance, offering your employees legal insurance as part of their benefits package can help lead them in the right direction when they need legal help. According to a recent study by ARAG, people with legal insurance feel their legal plan saved them an average of 8.5 hours1 when dealing with a legal issue and $1,987 in attorney fees.2 Additionally, 90 percent of plan members say legal insurance reduced their stress overall.1

Offering voluntary benefits such as legal and financial solutions can help your employees solve personal problems more efficiently to minimize the impact their work, as well as reduce stress and increase financial wellness.

1 2016 ARAG Plan Member Satisfaction Survey.

2 Average cost to employee without legal insurance is based on the average number of attorney hours for ARAG claims incurred in 2017 or 2018 and paid by December 31, 2019, multiplied by $368 per hour. $368 is the average hourly rate for a U.S. attorney with 11 to 15 years experience according to The Survey of Law Firm Economics: 2018 Edition, The National Law Journal and ALM Legal Intelligence, October 2018.