Everyone encounters legal issues in life — but not everyone has the means to pay an average hourly attorney rate of $3681 for professional legal services to help deal with them. Regardless of income level, everyone deserves to exercise their legal rights. So what bridges the gap between getting professional legal advice and an inability to pay for it?

A legal insurance plan

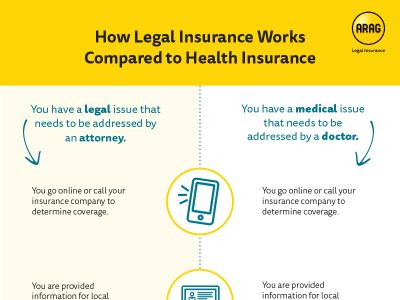

Just like health insurance is designed to help offset costly out-of-pocket medical procedures, you can pay a reasonable monthly premium for legal insurance — usually around $20 a month — to access an array of legal services. And with three out of four Americans experiencing at least one legal event a year,2 it makes more sense than ever to offer people an affordable place to turn for help handling life’s legal matters.

So how does it work?

Legal insurance is designed to help people plan ahead in life, protect what’s important and be prepared for unexpected legal matters. In exchange for a low monthly premium, legal plan members usually have access to a nationwide network of attorneys, who are available to:

- Advise and consult with you on legal issues.

- Review or prepare documents.

- Make follow-up calls or write letters on your behalf.

- Represent you, if needed.

Plus, there are countless scenarios employees may encounter in life that may not start out as a legal issue, but it escalates quickly. For example, if an employee encounters a property dispute, he or she can enlist the services of a credentialed attorney from the network to help review documents and provide consultation.

The same is true for an employee whose child is in legal trouble, looking to adopt a child or experiencing any number of legal issues.

In addition to attorney services for legal matters, legal plans usually include:

- The ability to create customizable legal documents online and access educational tools and resources.

- Additional services to help employees with all facets of their lives, such as financial counseling, tax services, caregiving services and identity theft resources.

The biggest advantage of having legal insurance is the peace of mind knowing you’ve got someone you can reach out to whenever you need a legal helping hand. That enables employees to more confidently exercise their legal rights and free to focus on their work. In return, employers are assured that their employees are not stressed or distracted by legal issues and able to work at their productive peak.

1 Average attorney rates in the United States of $368 per hour for attorneys with 11 to 15 years of experience, The Survey of Law Firm Economics: 2018 Edition, The National Law Journal and ALM Legal Intelligence, November 2018.

2 How Legal and Financial Issues Impact Employee Wellness. Russell Research for ARAG. December 2016.