When it comes to voluntary benefits, employees are expecting more, but they also want to be shown the financial value of the benefits. According to a Prudential study, the top reason employees don't take advantage of a voluntary benefit is because it's "too expensive." The study found that this result "may reflect confusion over benefits that can help employees manage their financial wellness," another area of growing importance in the workforce.

So where does legal insurance fit into all this? Can employees afford it? How does it tie in to financial wellness? The answers, of course, can be found in the numbers.

Crunching the numbers on legal insurance

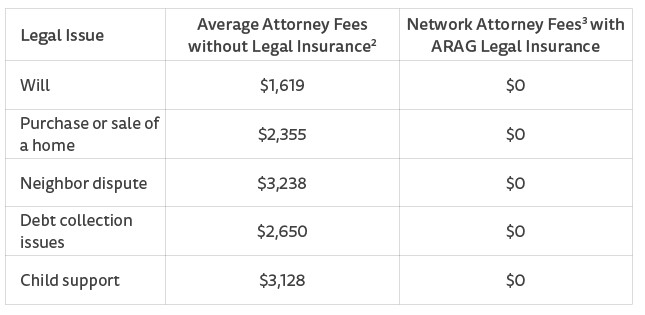

With three out of four Americans dealing with at least one legal event every year,1 it’s important to see the average cost employees would pay to work with an attorney for several common legal issues. Then it’s also helpful to compare those fees versus having an ARAG legal insurance plan.

When you factor in the monthly premium, which averages about $20 a month or $240 a year, employees are still spending less than the average attorney rate for one hour.2 And if they only use the plan once a year on an average matter, they could save more than a thousand dollars. Plus, keep in mind the majority of people (72%) experienced more than one legal event in one year.4 So the savings multiply.

All in all, ARAG has found that our legal insurance plan members save an average of $2,065 in attorney fees. (5)

With numbers like this and the likelihood of multiple legal events throughout their lives, the real question isn't "Can employees afford legal insurance," but rather, "How can employees afford not to have legal insurance?"

1How Legal and Financial Issues Impact Employee Wellness. Russell Research for ARAG. December 2016.

2Average cost to employee without legal insurance is based on the average number of attorney hours for claims incurred in 2016 or 2017 and paid by December 31, 2018, multiplied by $368 per hour. $368 is the average hourly rate for a U.S. attorney with 11 to 15 years experience according to The Survey of Law Firm Economics: 2018 Edition, The National Law Journal and ALM Legal Intelligence, October 2018.

3Attorney fees are 100% paid in full when using an ARAG network attorney for most covered matters.

4 ”How Legal and Financial Issues Impact Employee Wellness.” Russell Research for ARAG. February 2017.

5Average amount saved based on 2018 ARAG claims data.