During open enrollment, employers are understandably focused on core benefits like medical insurance and retirement plans. But with three out of four Americans facing at least one legal issue each year,1 more and more employees are looking to legal insurance as a voluntary benefit — and asking how it can help them.

As you introduce employees to the advantages of a legal insurance benefit, here are some common employee questions you might want to address.

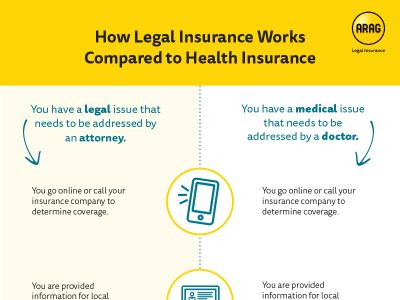

How does legal insurance work?

In many ways, legal insurance works like health insurance. A comprehensive legal insurance benefit is designed to make legal coverage and services more affordable and accessible for employees through a network of attorneys you can contact for assistance with things like legal counsel, document review and representation.

Some of the things that make a legal insurance benefit plan unique are that in most cases, your acceptance into the legal plan is guaranteed. You can purchase a plan and receive dependable coverage as long as you pay your premium. And unlike some other types of insurance, there's no waiting period. Plus, for most plans, your coverage starts immediately. You can get the professional legal help you need from day one. Finally, most legal insurance plans have no usage limits, which means you can get legal assistance multiple times throughout the year at the same low rate.

How can I use legal insurance?

Legal insurance can be used to help you plan ahead to protect what's important, like your family, finances and future through estate planning. For example, you can create a will, living will, a power of attorney, a trust and related documents to help you be prepared. Plus, many plans also provide access to online tools and resources, such as legal articles, and online legal forms you can create, store and update.

It can also help you with the unexpected situations in life that turn into legal issues. For example, let's say you just got your third ticket for speeding in a year, and you are now at risk of having your license suspended. You can contact an attorney to help you understand your options and represent you in court if necessary.

How much does legal insurance cost?

It can vary based on what type of plan your employer offers, but a comprehensive group legal plan usually costs around $20 a month, and is conveniently deducted from your paycheck like other benefits. With hourly attorney fees currently averaging $368 across the U.S.,2 a comprehensive legal insurance plan usually provides you access to attorneys, legal counsel and attorney fees at a much lower cost (or some plans that pay attorney fees in full) than if you were to seek legal assistance on your own.

How is a legal insurance plan different than what's offered through an employee assistance program (EAP)?

EAP plans vary on the depth and variety of services they offer, but typically offer employees access to an initial legal consultation, as well as discount or reduced-fee attorney services. Comprehensive legal insurance plans generally offer deeper coverage for legal services, ongoing access to attorneys at no additional cost and online tools and resources to help research their legal issues further.

Can I use a legal plan benefit for business or employer-related matters?

Comprehensive legal insurance plans are designed to help you deal with everyday matters in your personal life that could turn into legal issues; business-related matters or legal issues involving your employer are generally excluded.

Learn more about an ARAG legal insurance plan.

One example of a comprehensive legal insurance plan is offered by ARAG. These legal insurance plans typically cost employees around $20 per month and give employees access to a nationwide network of attorneys. When a member needs help with a legal matter, we’re here to help – whether it’s a simple question or complex issue. They can start a case online or contact us directly by answering a few questions, then they receive a CaseAssist® confirmation. This contains complete coverage details, including what is paid by ARAG, along with contact information for local network attorneys that can help.

Interested in learning more about how legal insurance can benefit your clients and their employees? Contact us for more information.

1 How Legal and Financial Issues Impact Employee Wellness. Russell ResearchSM for ARAG. December 2016.

2 Average hourly attorney rate for attorneys with 11 to 15 years’ experience according to The Survey of Law Firm Economics: 2018 Edition, The National Law Journal and ALM Legal Intelligence, October 2018.