In the nearly 25 years that I have been an attorney, I have worked with many clients who’ve used legal plan providers — and I can say without question that all legal service providers are not the same. Below I share my experiences with each of the major types of legal plans and explain why I would recommend legal insurance plans above all the others.

The main types of legal plans are:

- Document provider: I’ve had many clients come into my office after trying to use a document provider like LegalZoom or Rocket Lawyer to prepare their last will and testaments. They show me the document and it’s often missing information — then when I start to talk them through the document they prepared, they often don’t understand what most of it means. These “do-it-yourself” packages for estate planning are usually a disaster — plus people often don’t have them notarized or witnessed, which makes them null and void.

- Discount legal plans and Employee Assistance Programs (EAPs): Most EAPs I’ve worked with are discount legal plans. They offer a percentage off attorney fees; but from what I can tell, most people still end up paying a fair amount for their legal issues. These seem to be more of a legal referral organization — and in my experience, these plans do very little to vet the attorneys on their lists.

- Legal Insurance Plans: These comprehensive plans are the best for most consumers. They fully cover many legal matters for a reasonable monthly fee. My clients who have legal insurance plans like ARAG® feel like they have an attorney on retainer.

The bottom line is that to provide real value to employees or clients, the best legal services option is a legal insurance plan

What sets legal insurance plans apart from the other options?

- Common legal issues are covered: Clients using these services expect and receive coverage of their legal matters. The challenge with other legal services is that clients have the same expectations but still pay significant legal fees.

- Ease of use: My clients talk about how legal insurance plans have easy-to-use websites that help them identify attorneys by law and location.

- Quality outcomes: Clients who use legal insurance plans can rest assured they are working with an attorney who will help them resolve their legal issues. When using other types of plans, things can end up incomplete or done incorrectly. It’s heartbreaking to have to tell a client that his deceased parent’s will isn’t valid because it was done using an online document provider and wasn’t properly notarized or completed.

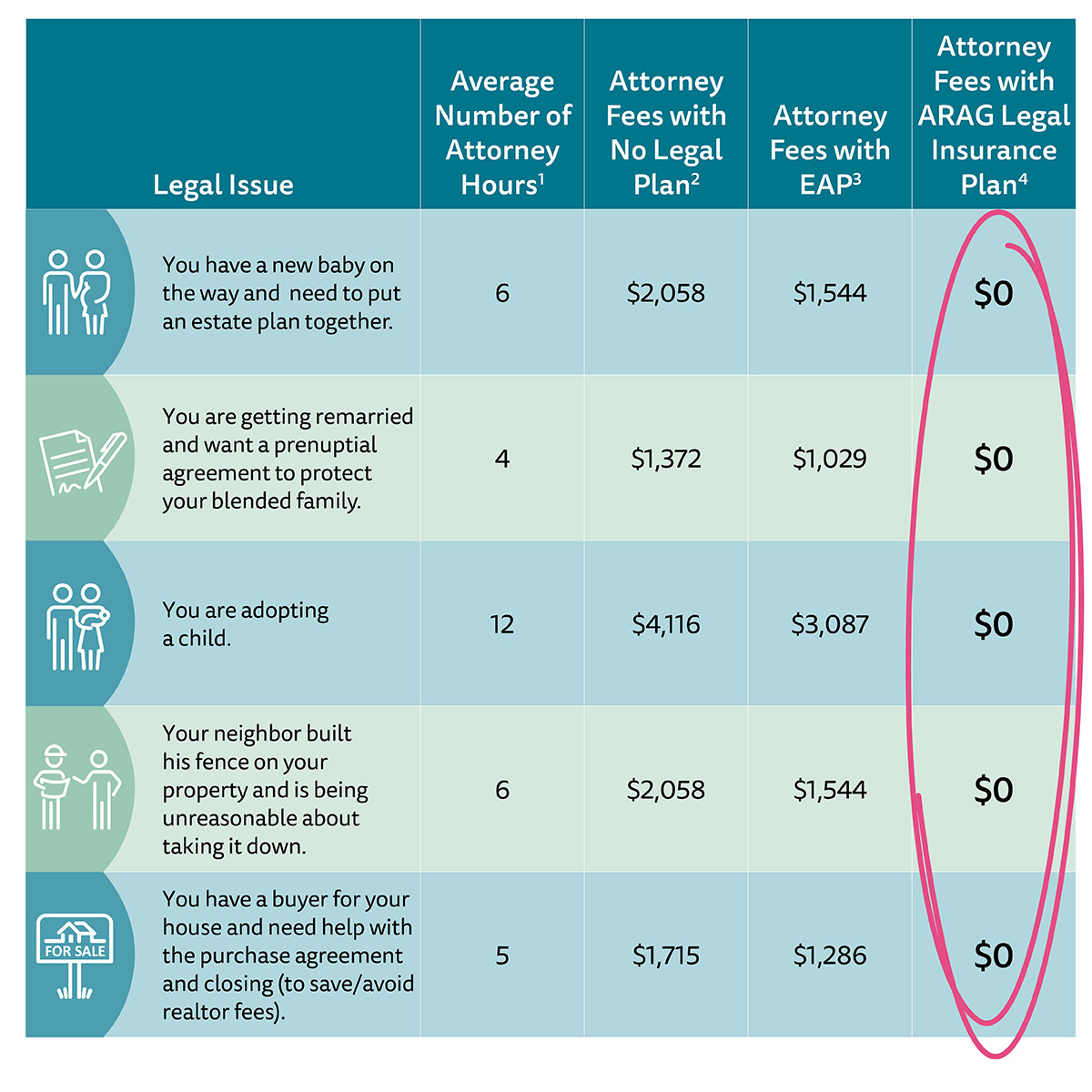

- True cost savings: Here are some real-life examples of legal issues I’ve helped clients with recently. I’ve estimated what it would cost without any legal plan, with an EAP/discounted legal service and with a legal insurance plan.

If I had a friend or family member ask me to recommend a legal plan that could make legal services more affordable, without hesitation I would refer them to a legal insurance plan like ARAG. It covers many matters, requires fewer attorney fees and provides support through educational resources and, perhaps most important from an attorney’s perspective, connecting clients with the right attorney.

Download Article

1Average number of hours for each example is based on Attorney Jennifer Coles’ estimates.

2 Attorney fees calculated by multiplying average number of hours by the average attorney rate in the United States of $343 per hour for attorneys with 11 to 15 years of experience (according to The Survey of Flaw Firm Economics: 2016 Edition) .

3 Attorney fees with EAP calculated by multiplying average number of hours by the average attorney rate in the United States of $343 per hour for attorneys with 11 to 15 years of experience by an estimated discount rate of 25%. Premium not included.

4 Premium not included.

Limitations and exclusions apply. Insurance products are underwritten by ARAG Insurance Company of Des Moines, Iowa, GuideOne® Mutual Insurance Company of West Des Moines, Iowa or GuideOne Specialty Mutual Insurance Company of West Des Moines, Iowa. Service products are provided by ARAG Services, LLC. This material is for illustrative purposes only and is not a contract. For terms, benefits or exclusions, call 800-758-2860.

The author is licensed to practice law in the state of Michigan. The opinions expressed in this article are those of the author, and are not endorsed by ARAG. This article is educational material only and not intended as legal advice.