We’ve all seen the commercials promising a free credit report. But is it really that easy to find out your score? And why do you even need to know your score? Read on to learn the answer to these questions and more about why credit scores are so important.

Why your credit score matters

Simply put, your credit score (also called your FICO score) is the most important number tied to your financial well-being. It impacts everything from buying a home to getting a credit card. Your credit score tells people and companies who are considering loaning you money (for a home mortgage, car, credit card, etc.) or working with you in any other financial capacity (like renting you an apartment) how big of a financial risk you are. If you have a good score, you’re seen as a less risky investment and are likely to get better interest rates and offers on loans.

What is a good credit score range?

A credit score can range from 300 to 850. Each of the three major credit bureaus (TransUnion®, Equifax® and Experian®) has slightly different criteria for what makes excellent, okay or bad credit. But on average the ranges are as follows:

- 750+: Excellent credit

- 700-749: Good credit

- 650-699: Fair credit

- 600-649: Poor credit

- Below 600: Bad credit

How is my credit score calculated?

There are five categories, with various weights, that decide your credit score.

1. Payment history (35%)

Have you been consistently late paying bills? Are debt collectors after you? This has a large impact on your good credit score.

2. Amount owed (30%)

What is your current amount of debt? How does that compare to your credit limits? This ratio is important – you don’t want the amount you owe to be close to how much you can borrow. Aim for less than 30 percent and definitely don’t go over 50 percent.

3. Length of credit history (15%)

The longer you have had credit cards or other types of credit accounts, the better.

4. New credit (10%)

Are you constantly applying for new lines of credit? That will negatively impact your score. If you are applying for loans, it’s smart to shop around, but don’t start applying for several credit cards a month or you will see your score take a dive.

5. Types of credit used (10%)

People who have different types of credit (credit cards versus a mortgage or other “installment” loans like car payments) are less of a risk to lenders as those with only one type of credit – as long as you’re making those payments on time.

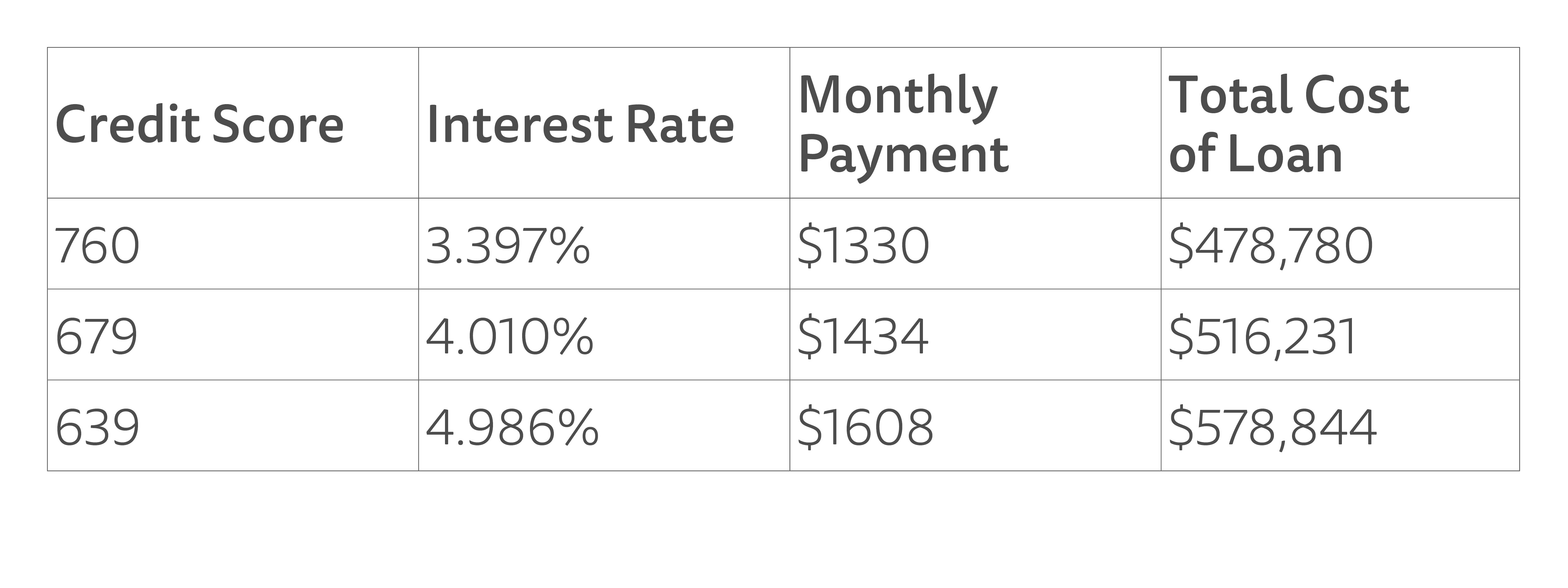

How does my credit score affect interest rates on loans?

Say, for example, you want to buy a home. Using one example from MyFico.com on a 30-year fixed, $300,000 mortgage, here's how your credit score could affect your interest rate – and how your rate would affect your monthly payment and overall cost of the loan.

How do I check my credit score?

You can get a free credit report every year from each of the major credit bureaus — Equifax, Experian and TransUnion — by visiting www.annualcreditreport.com. This is the only website for free credit reports authorized by the federal government. You may have a different score with each, so you’ll want to get reports from all three bureaus – you can get them all at once or spread them out (e.g., get one from Equifax in January, Experian in May and TransUnion in September).

Many credit cards now also have services that will provide your FICO score. There are also many sites online that provide credit reports — like the ones you see in TV commercials — but be wary of using companies that require your credit card information.

How often should I check my credit score?

The recommended time frame to check your credit report is one to two times every year. However, it’s a good idea to check it more frequently if you have a credit card that provides you with a free FICO score. Additionally, you might want to take advantage of the fact that you can get one free report every year from the major bureaus and stagger those every four months to check.

Will checking my credit hurt my score?

It all depends on the company you use, the type of application you submit and several other factors. When you check your report yourself, no points are deducted. However, when a company issues a hard inquiry, which is a check usually done by a financial institution, it might take anywhere from three to five points off your score. Soft inquiries, usually done for background checks, do not have any effect. Additionally, too many applications at one time can also remove more than a few points.

All company names and trademarks are the property of their respective owners.