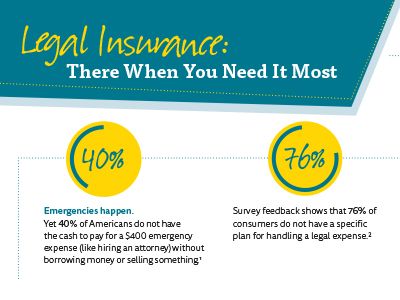

Imagine going through life without health insurance, car insurance or home insurance:

- You’d pay an arm and a leg for the medical procedure your daughter needs.

- When you get into a fender bender, you wouldn’t be able to say, “my insurance is paying for the damages.”

- You’d be forced to wipe out your emergency fund when that hail storm came through and damaged your roof.

The insurance premiums we pay are worth it to protect ourselves, our families – and our bank accounts.

How does legal insurance help me?

Like any insurance you buy, legal insurance gives you peace of mind. When you do have to deal with a legal situation, you know your insurance company has you covered. You won’t have to worry about attorney costs or searching for the right attorney. That saves you time and money – things we could all use more of.

What kind of legal issues will I experience in life?

Legal insurance covers a variety of personal legal issues that you may experience throughout your life, ranging from the planned to the unplanned. Whether you’d like to call up an attorney to get some advice about a legal problem you’re experiencing, want a legal document created or need an attorney to represent you in court, legal insurance is there to save you time and money.

Are you getting married and interested in creating a prenuptial agreement? Legal insurance covers the attorney fees for drafting that document.

What if your teen gets in trouble for underage drinking? When you have legal insurance, you can get an attorney to represent your child but don’t have to worry about the attorney fees.

Did your next-door neighbor add landscaping that is creating water run-off onto your property and causing major damage? Your legal insurance connects you with an attorney to help and pays his or her fees.

Do you want to adopt a child but are overwhelmed at the cost? With legal insurance you can save thousands of dollars because your adoption attorney’s fees are covered.

Have you been meaning to create a will, trust, powers of attorney and end-of-life documents? Legal insurance covers the attorney fees and saves you time because it’s easier to connect with an attorney.

Top 10 Ways People Use Their Legal insurance*

- Wills: Determines who you want to leave property and assets to, name person in charge of estate and guardian of any minor children.

- Trusts: Protect property/assets (and can reduce taxes), name person to manage assets and people who will receive the assets.

- Divorce: Uncontested (when couple agrees on terms to end the marriage) and contested (when couple can’t agree and needs the court to help determine the outcome).

- Traffic issues: Moving violations such as a speeding ticket.

- Property transfers: Change ownership of a property, such as when you sell your home.

- Consumer protection: Range of issues, including debt collection issues and problems with contracts or warranties for products and services, such as cars or contractor work.

- Bankruptcy: Eliminate or reduce debt by filing for personal, non-business bankruptcy.

- Defense of civil damage claims: Someone sues you for damage you allegedly caused to them or their property.

- Property protection: Issues such as neighbor disputes, contract or financing disputes about your home, disputes with your landlord.

- Family law decree: Handle child support and child custody issues.

* Based on ARAG 2017 claims data.

How does legal insurance work?

You realize you could really use an attorney to help you with a certain legal issue. When you have a legal insurance plan, you can go online or call and be connected to a local Network Attorney who practices in the area of law you need. You can email, call or meet with the attorney in-person for advice, consultation and/or representation. If your legal matter is fully covered by your insurance plan and you use a Network Attorney, you won’t have to pay any attorney fees.

What happens if my legal matter isn't covered by my insurance?

Sometimes you may experience a situation that isn’t fully covered by the legal insurance plan. If this happens, there are still several benefits you can take advantage of:

- The plan may cover a certain number of attorney hours for that legal matter.

- The plan offers reduced fee benefits so for matters that aren’t fully covered you’ll only pay a fraction of a Network Attorney’s normal hourly rate.

- The plan provides access to Network Attorneys over the phone who can offer you advice and guidance on personal legal issue.

- The plan has online resources such as educational guidebooks and DIY legal documents.

How can I get legal insurance?

Explore ARAGlegal.com to learn more about what legal matters are covered by legal insurance and to find the best plan for you and your family.