Ease Your Employees' Financial Burdens

Employers have realized that focusing on preventative care and physical wellness decreases health care costs (for the employee and the company) – and the same can be done with financial wellness.

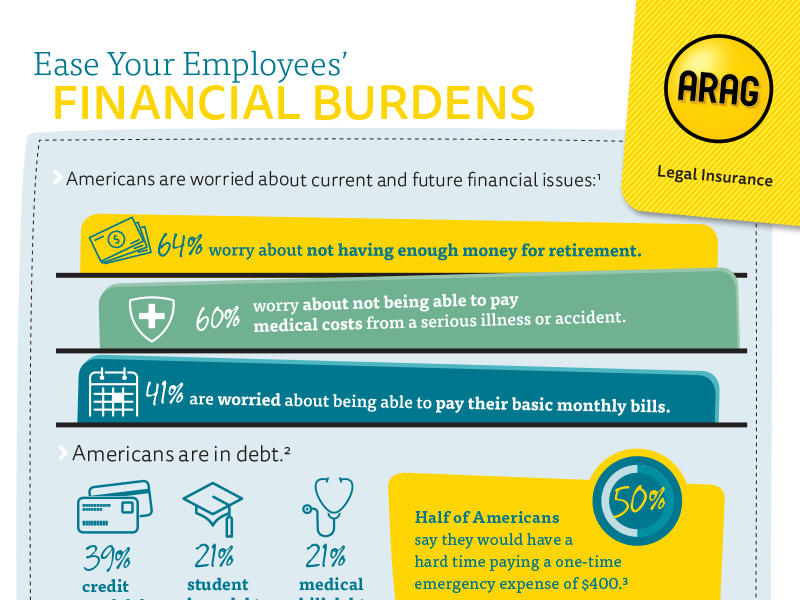

DownloadAmericans are worried about current and future financial issues:

- 64% worry about not having enough money for retirement.

- 60% worry about not being able to pay medical costs from a serious illness or accident.

- 41% are worried about being able to pay their basic monthly bill.

Americans are in debt:

- 39% credit card debt

- 21% student loan debt

- 21% medical bill debt

Half of Americans say they would have a hard time paying a one-time emergency expense of $400.

Those struggling financially are more stressed and in poorer health:

- 66% of people struggling with finances are stressed and 20% are in poor health.

- 21% of people not struggling with finances are stressed and 4% are in poor health.

- 48.8% increase in employee satisfaction when their benefits package includes a wellness program with financial services.

People want help figuring out their finances: Nearly one in four employees say personal finance issues distract them from their work.

Top financial goals employees want help with:

- Budgeting and debt (people 44 and younger)

- Retirement (people 45+)

ARAG plan members save an average of $1,945 in attorney fees per legal issue.

Employers have realized that focusing on preventative care and physical wellness decreases health care costs (for the employee and the company) - and the same can be done with financial wellness. If people learn how to budget, plan and make smart money decisions, your company and your employees will be more productive, less stressed and more financially healthy. Contact us for more information.